| Feature | Details |

|---|---|

| Portal Name | GST Portal |

| Purpose | Online platform for all GST tasks; IT backbone for Indian GST. |

| Ownership | 100% Government (Central & State). |

| Key Functions | Registration, Returns, Payments, Refunds, E-way Bills, E-invoicing, User Services, Law Info, Taxpayer Search. |

| Key Features | Online, unified, digital, transparent, ITC, simplified, secure, updated. |

| For | Taxpayers, Applicants, Practitioners, Public, Government. |

| Official Site | www.gst.gov.in (GSTN) |

What is GST in India?

GST is a comprehensive, multi-stage, destination-based tax levied on the supply of goods and services across India. Think of it as a single tax that has replaced a multitude of indirect taxes previously collected by both central and state governments, such as Excise Duty, VAT, Service Tax, and more.

The beauty of GST lies in its seamless flow of input tax credit, where businesses can claim credit for taxes paid on inputs, ultimately reducing the final tax burden on the consumer. This helps in mitigating the cascading effect of taxes (tax on tax) and makes Indian products more competitive. GST is generally structured into three main components:

- CGST (Central Goods and Services Tax): Levied by the Central Government on intra-state (within the same state) supplies.

- SGST (State Goods and Services Tax): Levied by the State Government on intra-state supplies.

- IGST (Integrated Goods and Services Tax): Levied by the Central Government on inter-state (between different states) supplies and imports.

The GST Portal: Your Digital Assistant

The official GST portal (www.gst.gov.in) is a robust online platform that empowers taxpayers to manage their GST compliance efficiently. From the comfort of your home or office, you can:

- Apply for GST registration

- File various GST returns (GSTR-1, GSTR-3B, etc.)

- Make GST payments electronically

- Claim input tax credit

- Track application status in real-time

- View your ledgers (e-cash, e-liability, e-credit)

- Generate e-way bills

- Access compliance tools and reports

Getting Started: The GST Registration Process

If your business turnover crosses a certain threshold (currently ₹40 lakhs for goods and ₹20 lakhs for services, with lower limits for specific states), GST registration is mandatory. Here's a simplified overview of the online registration process:

- Visit the GST Portal: Head over to www.gst.gov.in.

- New Registration: Click on "Services" > "Registration" > "New Registration."

- Part A of Form GST REG-01:

- Select "Taxpayer" as the type of registration.

- Choose your State/UT and District.

- Enter your Legal Name of the Business (as per PAN), PAN, Email Address, and Mobile Number.

- Complete the CAPTCHA and click "PROCEED."

- You'll receive separate OTPs on your registered email and mobile number. Enter them to verify.

- Upon successful verification, a Temporary Reference Number (TRN) will be generated. Make sure to note it down!

- Part B of Form GST REG-01:

- Go back to the "New Registration" page and select "Temporary Reference Number (TRN)."

- Enter your TRN and the CAPTCHA, then click "PROCEED."

- Enter the OTP received on your mobile/email.

- Now, you'll enter the detailed application form. This involves providing:

- Business Details: Trade Name, Constitution of Business, Date of Commencement, etc.

- Promoter/Partner Details: Personal information, PAN, address, etc.

- Authorized Signatory Details: Information of the person authorized to sign documents.

- Principal Place of Business: Address proof (rental agreement, electricity bill, etc.).

- Additional Places of Business (if any).

- Goods and Services Details (HSN/SAC codes).

- Bank Account Details: Attested copy of the first page of your bank passbook/statement.

- Aadhaar Authentication (optional but recommended for faster processing).

- Verification and Submission:

- Review all the details carefully.

- Submit the application using Electronic Verification Code (EVC) sent to your registered mobile number, or through Digital Signature Certificate (DSC) for companies.

- Application Reference Number (ARN): Once submitted, you'll receive an Application Reference Number (ARN) via email and SMS. This is crucial for tracking your application status.

The GST department will review your application. If they need more information, they'll issue Form GST REG-03. You'll need to respond in Form GST REG-04 with the requested details within 7 working days. Once approved, you'll receive your GSTIN and a Certificate of Registration in Form GST REG-06.

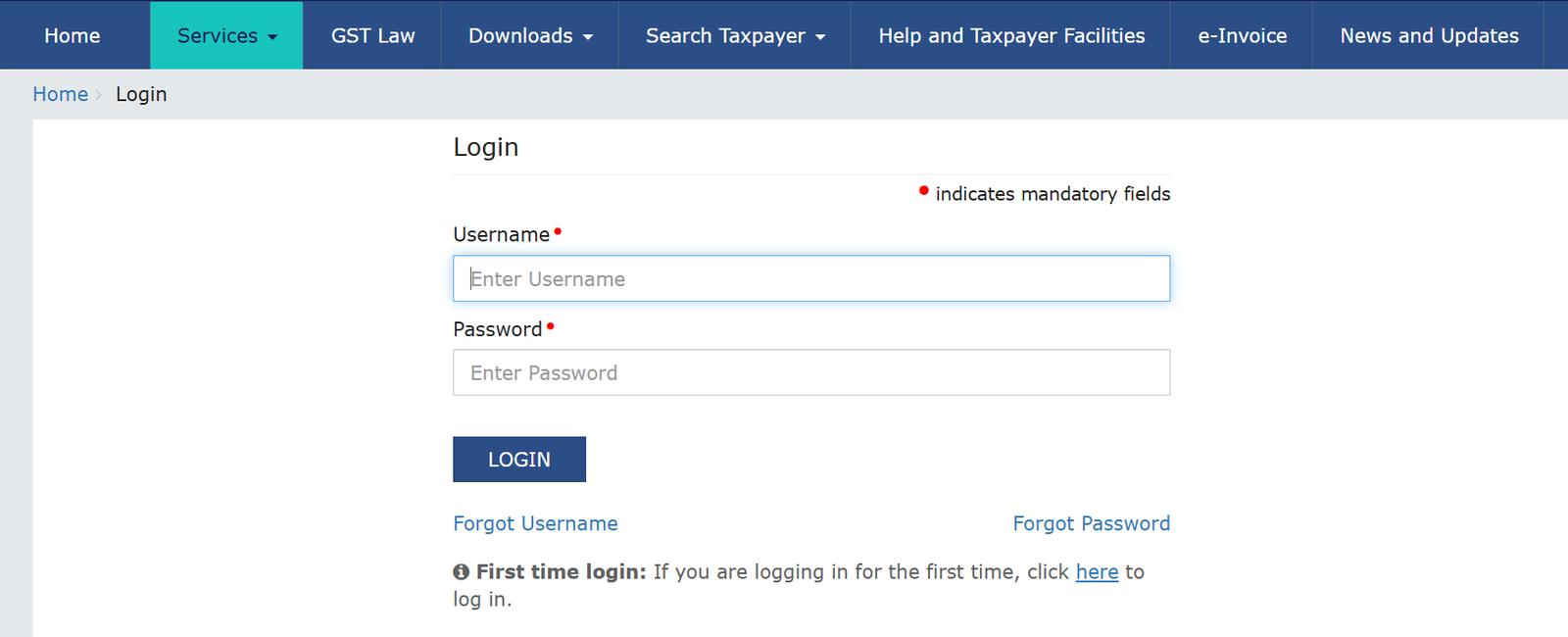

Logging In to the GST Portal

Once you have your GSTIN and have set up your username and password (which happens during your first-time login process), accessing the portal is straightforward:

- Visit the GST Portal: Go to www.gst.gov.in.

- Click "Login": You'll find the "Login" button on the top right-hand corner of the homepage.

- Enter Credentials:

- Enter your Username.

- Enter your Password.

- Enter the CAPTCHA code.

- Click "LOGIN": You'll likely receive an OTP on your registered mobile number and email for a second layer of authentication. Enter this OTP.

- Dashboard Access: Upon successful login, you'll be directed to your GST dashboard, where you can access various services.

First-Time Login Tip: If you're logging in for the very first time with your provisional ID/GSTIN and the temporary password received, the system will prompt you to create a new username and password of your choice.

Checking Your GST Status

Keeping tabs on your GST registration or application status is easy on the portal:

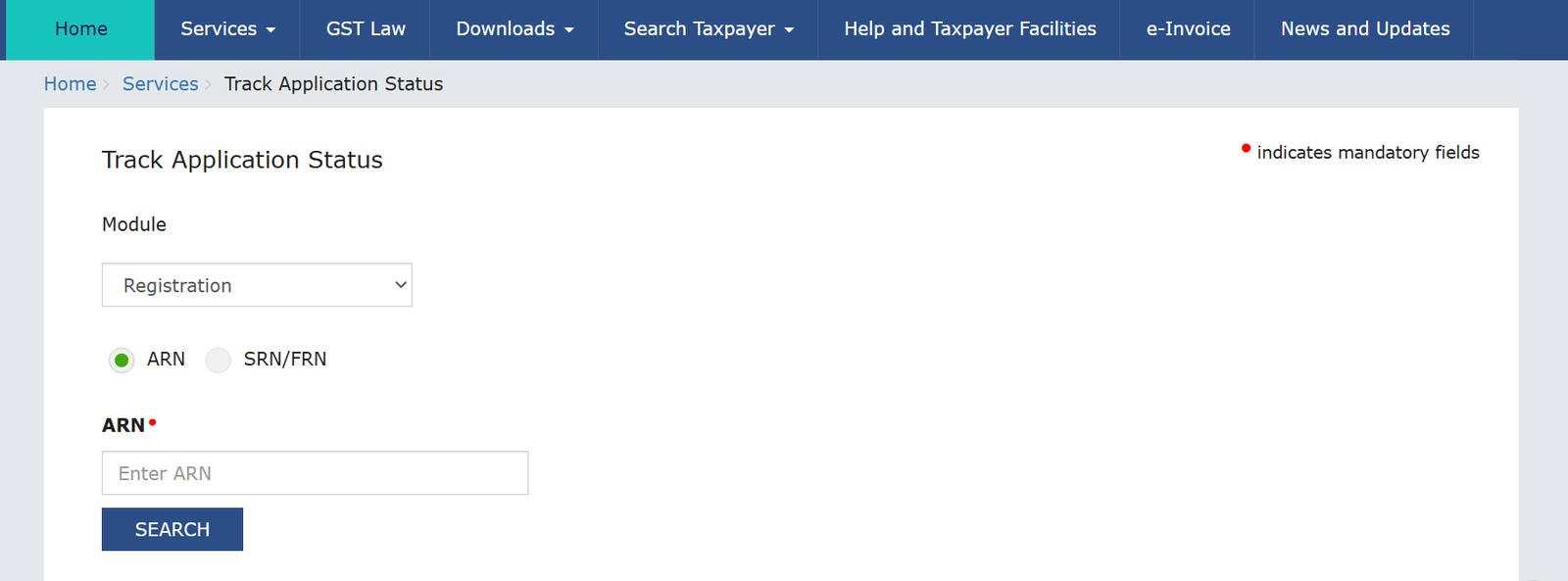

1. To check GST Application Status (before registration is complete):

- Go to www.gst.gov.in.

- Navigate to "Services" > "Registration" > "Track Application Status."

- Select "Registration" from the "Module" dropdown.

- Enter your ARN (Application Reference Number) that you received after submitting your registration application.

- Enter the CAPTCHA and click "SEARCH."

- The status of your application (e.g., "Pending for Processing," "Pending for Clarification," "Approved," "Rejected") will be displayed.

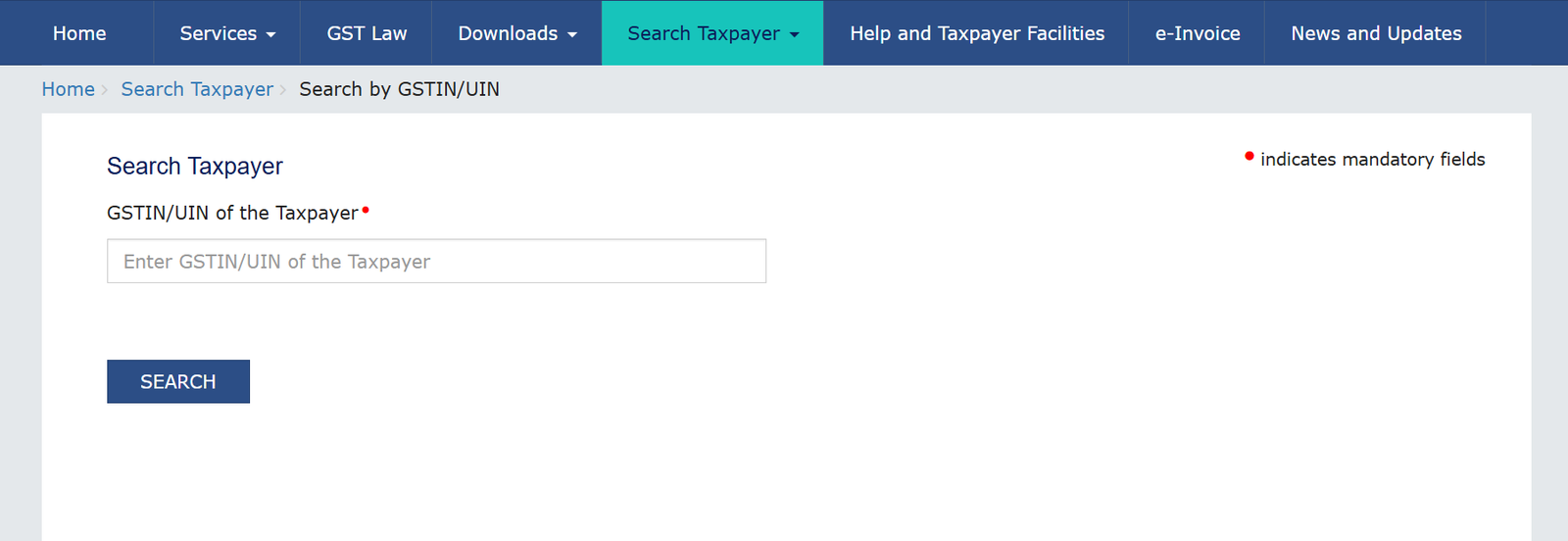

2. To check GSTIN Status (for already registered businesses):

- Go to www.gst.gov.in.

- Navigate to "Search Taxpayer" > "Search by GSTIN/UIN."

- Enter the 15-digit GSTIN you want to verify.

- Enter the CAPTCHA and click "SEARCH."

- The portal will display details like the legal name of the business, registration status (active/inactive), date of registration, and business type.

You can also search for a GSTIN by PAN by going to "Search Taxpayer" > "Search by PAN" and entering the PAN. This will show you all GST registrations linked to that PAN.

FAQ's

Is GST mandatory for all businesses?

No, GST registration is mandatory only if your aggregate turnover exceeds the prescribed threshold limit (currently ₹40 lakhs for goods and ₹20 lakhs for services, with some exceptions for special category states). However, some businesses are compulsorily required to register irrespective of turnover, like those making inter-state taxable supplies.

What taxes did GST replace?

GST subsumed many central and state indirect taxes, including Central Excise Duty, Service Tax, VAT, Purchase Tax, Luxury Tax, Entertainment Tax, and various cesses and surcharges.

What are the main components of GST?

The main components are CGST (Central GST), SGST (State GST), and IGST (Integrated GST).

What is an HSN code?

HSN stands for Harmonized System of Nomenclature. It's an internationally recognized system of classifying goods for tax purposes. Similarly, SAC (Services Accounting Code) is used for classifying services.

Can I register multiple businesses under one GSTIN?

No, generally, a single GSTIN is issued per legal entity in a particular state. If you have multiple business verticals within the same state, you might apply for separate registrations for each, if required. If you have businesses in different states, you need separate GST registrations for each state.

What happens if I don't register for GST but am liable to?

Operating without mandatory GST registration is a criminal offense and can lead to heavy penalties, including fines and prosecution.

Is GST registration permanent?

Yes, once granted, the GST registration certificate is generally permanent unless it's surrendered, cancelled, suspended, or revoked by the authorities.

What is the Composition Scheme under GST?

The Composition Scheme is an option for small taxpayers (with turnover below a certain limit, usually ₹1.5 crore, and ₹75 lakhs for North-Eastern states and Himachal Pradesh) to pay GST at a fixed, lower rate of turnover, reducing their compliance burden.

What is an ARN?

ARN stands for Application Reference Number. It's a unique number generated after you successfully submit your GST registration application, which you can use to track its status.

How long does it take to get GST registration?

If all documents are submitted correctly and the application is complete, it typically takes around 3–7 working days for the GST department to process and approve the registration.